Introduction: The Old Man and the Sea

The definition of insanity is doing the same thing over and over again and expecting a different result.

—AUTHOR UNKNOWN

A WEEK BEFORE CHRISTMAS IN 1999, I met the acclaimed coastal geologist Orrin H. Pilkey on the Outer Banks of North Carolina, a more or less continuous spit of sand extending along half of the state’s four-hundred-mile coast. We had come to talk about erosion, hurricanes, and the relentlessly defiant pace of development along the state’s once-pristine shore. Billions of dollars of property now perched in harm’s way. Parts of Kitty Hawk, Kill Devil Hills, and Nags Head had lost entire rows of beach houses to the sea. Dozens of other houses now wobbled on stilts in the surf. Some industrious owners had placed mesh bags filled with giant boulders around the pilings. But these makeshift attempts at engineering provided only so much help. One by one, the houses toppled into the ocean or were condemned by the towns—“red-tagged,” in the parlance of local zoning officials.

“It’s madness,” Pilkey exclaimed as we examined a sliver of beach where two rows of homes were now underwater. “I am sometimes condemned for saying this, but that’s what it is—madness and hubris of unbelievable proportions.”

Pilkey is a short, square hobbit of a man, with an unruly gray beard and a disarming sense of humor. Depending on your point of view, he is either a prophet or the Antichrist of the coast. For more than half a century, he has been churning out scientific papers (more than 250) and books (45 and counting) spotlighting the immeasurable beauty of barrier islands and the illogic of building houses on them. The mayor of a beach town in New Jersey once blurted, “I hate him, hate him, hate him,” after Pilkey pointed out that his shoreline was rapidly washing away. In 1991, the town of Folly Beach, South Carolina, passed a resolution condemning Pilkey’s studies as “insulting, uninformed and radical.” Pilkey framed the resolution and hung it on his office wall at Duke University, where he ran the marine geology program.

Now eighty-four, Pilkey is retired, yet he’s still challenging the often reckless development of the coasts and the billions in government subsidies and bailouts that normalize risks and encourage rebuilding in harm’s way after hurricanes and floods. “The mayors and politicians like to call hurricanes ‘natural’ disasters,” he said. “But in my opinion, there’s nothing natural about them. They are man-made. Barrier islands are always moving. Beaches are always eroding. It’s only a problem when you put a house there.”

This is a book about water and risk—that is, how Americans live with water and accommodate its beauty, power, and fury. It grew out of my long-standing love affair with the ocean and what I have watched occurring at the coast over nearly seven decades. It isn’t enough to say that rising seas and larger, more ferocious storms threaten trillions of dollars of property. What is equally critical to understand is how we arrived at this point, with so much at stake and so few good choices. Which human and economic forces propelled Americans to build in one of the most ecologically fragile and dangerous places on earth—coastal floodplains—and then reward those decisions without truly apportioning the risks?

What we think of as the coast is a relatively modern phenomenon. True, ancient peoples ferried across the bays and sounds to fish and hunt. And Gilded Age industrialists built Victorian mansions, hotels, and hunting clubs along the Atlantic and Gulf Coasts. However, developers didn’t turn to the coast in earnest until the last century, when postwar prosperity enabled Americans to indulge themselves after years of sacrifice. Over the next few decades, a surge of second homes filled beach towns and communities along the ocean, gulf, and bays. That wave of development has only accelerated since, backed by an array of federal and state programs that provide inexpensive financing and tax breaks; offer heavily subsidized flood insurance; underwrite roads, bridges, and utilities; and distribute billions more in disaster aid to help beach towns rebuild after hurricanes and floods—setting the stage for a seemingly endless loop of government payouts. It isn’t an exaggeration to say that without the federal government, the coast as we know it simply wouldn’t exist.

One can fairly argue that it was an unintentional policy. After all, there was never a national debate about whether to develop the coasts. Critical choices were left to beach-town politicians, who controlled land-use, zoning, and building decisions and, unsurprisingly, favored development. Later, when state and federal officials tried to slow the unrestricted building, politicians and developers stiff-armed them aside. The result, this book argues, is one of the most costly and damaging planning failures in American history, with at least $3 trillion worth of property now at risk of flooding and catastrophic storms, and the U.S. Department of the Treasury serving as the insurer of last resort.

The costs are multiplying each decade. Hurricanes and coastal storms now account for sixteen of the twenty most expensive disasters in U.S. history, with well over half a trillion dollars in damage in the last two decades alone—far more than the damage caused by earthquakes, wildfires, and tornadoes combined. Worryingly, the pace of destruction is accelerating, with seventeen of the most destructive hurricanes in history occurring since 2000. In 2017, Harvey, Irma, and Maria resulted in over $300 billion in losses, the most in a single year. As I write, Florence is bearing down on an area of North Carolina that has been repeatedly pummeled by storms, yet is rapidly adding houses and people. No doubt the damage will cost taxpayers billions. Meanwhile, federally subsidized flood claims at the coast have increased twentyfold in the last two decades and account for three-quarters of all flood losses nationwide, effectively leaving the government’s insurance program insolvent. Now, with rising seas, warmer oceans, and more property than ever before at risk, even more calamitous storms—and government payouts—are inevitable.

The most pressing question is, why do we keep repeating the same mistakes over and over? The development of the coasts is a peculiarly American expression of optimism, commerce, and defiance—even willful blindness. After each hurricane, Americans keep rebuilding, normalizing their risky choices. At least two million houses have been erected on low-lying barrier islands and bays in recent decades, many of them vacation homes and investment properties insured by the federal government. Surprisingly, some of the riskiest properties benefit from the most generous taxpayer subsidies, despite flooding repeatedly. Yet half a century after the government got into the business of insuring vacation homes at the beach, no one can explain how it happened, let alone whether it is an appropriate role. One can fairly argue it was an unintentional policy, and that the costs have been, and will be, astounding. Researchers have estimated that even a relatively modest one-foot rise in sea level will nearly double the nation’s flood losses in the coming decades. A more likely three-to-six-foot rise will bury over one million homes underwater, leaving them inaccessible, if not modern-day versions of the mythical sunken city of Atlantis.

In 2017, politicians in Texas dismissed climate change as pseudoscientific opinion even as Houston was drowning in epic rainfall from Hurricane Harvey, flooding more than 300,000 properties. Now, without so much as a trace of irony, they are pleading for billions in federal aid to save them from their own arrogance and mistakes. And Congress is going along. It has awarded nearly $130 billion so far in disaster aid and billions more to armor the Texas coast. Meanwhile, the Trump administration is gutting scores of regulations aimed at slowing the looming threats, freeing coal-fired power plants and manufacturers to spew carbon dioxide and methane into the already oversaturated atmosphere. In March 2018, the Federal Emergency Management Administration (FEMA) even dropped any mention of “climate change” from its strategic plan.

Leaders from New York City to Miami to Galveston, Texas, have been left to devise their own solutions. Some are thinking deeply about what it means to live with rising water, torrential rain bombs, and staggeringly destructive hurricanes. Yet far more are still in denial or focusing on temporary measures, including pumping sand in front of million-dollar beach houses, only to watch it wash away in the next storm. There is a startling gap in their reasoning. Instead of thinking in geologic time, they are measuring time in days, months, and years, until the next hurricane or nor’easter inundates their towns and they again turn to federal taxpayers for help. Social scientists refer to such short-term thinking as the Tragedy of the Commons, in which people and politicians favor temporary solutions over their own long-term interests—only in this case, the decisions are subsidized by the U.S. Treasury.

The Geography of Risk is, in part, a meditation on the question of risk: How much should be private; how much public? The cost of storm damage, once borne by beach towns and homeowners, is now largely paid for by federal taxpayers. Most of them live far from the coasts and can only dream of owning a house at the beach, let alone an oceanfront mansion.

In the 1950s, the federal government covered just 5 percent of the cost of rebuilding after hurricanes. Today, it pays for 70 percent. And in some cases, it pays for 100 percent. It is no accident that the federalization of disasters coincided with the explosive development at the coasts. As coastal property values soared, the expectations of politicians and homeowners shifted dramatically as well, and the nature of risk with it, from private to public. Now, with government payouts for coastal disasters rising precipitously and beach-town politicians clamoring for even more money to protect their towns, the question of who pays is more important than ever.

Recently, the U.S. Army Corps of Engineers unveiled a series of proposals to protect New York Harbor and Lower Manhattan from hurricane surge. One idea calls for building a massive hurricane barrier from Sandy Hook to the Rockaways, in Queens. The barrier and surge gates would be similar to ones in the Netherlands, which can be closed during storms. The estimated cost is $20 billion, but even that may be low. Hundreds of millions more would be needed to operate the gates. Federal taxpayers are likely to cover the cost.

Strikingly, that’s just one project. Texans want $61 billion to protect their coast from hurricanes and floods. That includes a $31 billion barrier and levee to protect Galveston and the Houston Ship Channel, which is lined with oil refineries and petrochemical facilities. The huge project is backed by the state’s senators, Ted Cruz and John Cornyn, both reliable critics of federal spending and climate change. Neither has mentioned the controversial role of the oil industry in global warming or suggested oil titans pay for some of the cost.

Altogether, there are thousands of miles of heavily developed shoreline, barrier islands, and estuaries along the Atlantic and Gulf Coasts. The challenge of scaling up to protect all the property would be monumentally difficult, not to mention prohibitively expensive. Will we build a wall around the entire Florida peninsula? Put gates and barriers along hundreds of miles of New Jersey bays? Backers of these projects talk about building resilient, sustainable coasts. But even then, they acknowledge that the barriers, levees, and sand dunes will not eliminate flooding. Given time, they allow, water will always win out.

Decades ago, Orrin Pilkey made the case for a slow, managed retreat from the coast. No one listened. Developers called Pilkey naive. Homeowners will never leave, they said. There is too much money and property at stake. Instead, they successfully lobbied for billions in aid and crowded the shores with larger and more expensive homes.

“We are going to have to retreat at some point,” Pilkey continues to insist. “And it will be sooner than later. There is no question about that, with the seas rising, warmer oceans, and more catastrophic storms. One of the reasonable ways would be, don’t allow people to repair destroyed homes. But people insist, storm after storm, time after time. It’s mind-blowing, really.”

1.

The Deal of the Century

ON A WARM SUNDAY MORNING IN AUGUST 1926, Morris L. Shapiro climbed into his new Willys-Knight sedan and started alone down the New Jersey coast. The idea was to break the car in slowly by taking it out for short drives, until the odometer reached one hundred miles. At that point, he could drive as often and as far as he liked.

The Shapiros—Morris; his wife, Jennie; their sons, Jerry and Herb; and their daughter, Muriel—were spending the month of August in a large Victorian rental on Fourth and Ocean Streets in Bradley Beach, a popular summer resort along the northern New Jersey shore, an hour’s drive from the bustling cities of Newark, Elizabeth, and Irvington. It was an extravagance, to be sure, but one Morris could afford. He owned the largest shoe store in Elizabeth, near the busy port, and recently had ventured into real estate, buying and selling land and building single-family homes in the Elmora section of the city.

Morris was supposed to go only a short distance that morning, but the ride was so pleasantly distracting that he didn’t notice the miles slipping by. Soon, he was in Ocean County, on Route 9, a winding two-lane blacktop then no wider than a farm road. Ocean County was one of the largest in the state. But it was far from the cities and isolated, with small fishing villages shouldering Barnegat Bay, blueberry and cranberry farms squeezed inside a sprawling forest of pygmy pines and cedar creeks, and black-water rivers and bogs spilling into lush salt meadows. Many of the towns and crossroads appeared to Morris to have more in common with the sleepy Deep South than the busy Northeast.

When he reached Manahawkin, a fishing colony located on the southernmost edge of Barnegat Bay, Morris saw a wooden sign advertising Long Beach Island and on a whim turned left onto a rickety wooden bridge only a foot or two higher than the water. It is unclear whether Morris had ever heard of the slender barrier island before, but he probably hadn’t. It was a slow, nerve-wracking drive across the bay, but the view was spectacular. The vibrant colors exploded at Morris—the blue-green swirl of the shallow bay, no more than six feet deep in most places; the golden ridge of sand dunes across the water; and the even deeper chromatic blue of the Atlantic Ocean limning the horizon. The popular beach resorts at the time, including Asbury Park and Long Branch in North Jersey and Atlantic City to the south, were small cities, with redbrick hotels, crowded boardwalks, and amusement piers projecting dangerously over the ocean. By contrast, Long Beach Island was nearly virgin and empty. Morris didn’t see any boardwalks, piers, or tall buildings. In fact, other than a small cluster of cedar-shake bungalows at the end of the wooden causeway connecting the island to the mainland, he didn’t see any houses at all.

Morris turned right and drove four or five miles along a sand-and-gravel road toward an area of the island now known as Beach Haven Park. What he saw was a flat, windswept space with rolling sand dunes along the ocean and clumps of bayberry, ivy, honeysuckle, and wild blackberries near the bay. The island itself was eighteen miles long from tip to tip, but low-lying and narrow. Morris guessed it couldn’t be more than a half mile at its widest. In any case, it wasn’t so wide he ever lost sight of the ocean or lush salt meadows bordering Barnegat Bay.

Morris slowed his sedan, enthralled and curious. At a certain point, he encountered a man standing outside a humble plywood office. As best as anyone can recall, the man’s name was Renaldo Kenyon. He was the owner of one of the few hotels on the island and, like Morris, fancied himself a developer on the side.

Without trying to appear too eager, Morris inquired whether Kenyon knew of any land for sale.

As a matter of fact, Kenyon replied, he happened to have a fifty-three-acre plot available, and Morris was standing on it. Best of all, Kenyon added, it stretched from the ocean to the bay, nearly one square mile of prime real estate.

Kenyon was asking $1,000 an acre—or $53,000 altogether. It was a lot of money even for someone as relatively well off as Morris Shapiro. But Morris did some quick math to determine how many lots he could fit on fifty-three acres, and decided it would be enough to double or triple his investment. But before he purchased anything, he informed Kenyon he needed to talk to his wife, Jennie. She was his partner in everything he did, smart, with her own knack for numbers. Morris told Kenyon he would return in a week. He wanted to bring Jennie to show her around. If she approved, he would buy the land.

* * *

A week later, Morris and Jennie Shapiro made the long drive to Long Beach Island. Initially, Jennie was unimpressed. She was used to the busy North Jersey beaches, which filled with visitors on weekends. The scruffy, narrow island was wild and remote. The streets were gravel and sand, and there were hardly any houses or businesses, as far as she could see. She asked Morris who would want to travel all the way out here, miles at sea, so far from the cities.

It was a good question, and Morris didn’t have a ready answer. Long Beach Island was located midway along the 141-mile-long New Jersey coast, with no major highways connecting it with the cities. The nearest resort, Atlantic City, was an hour’s drive to the south; the urban centers of Philadelphia, Newark, and New York City were hours away by train.

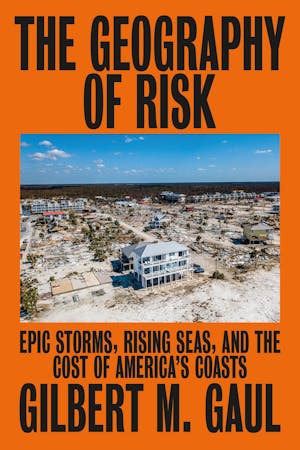

In 1926, Morris Shapiro and his wife, Jennie, bought fifty-three acres from ocean to bay on Long Beach Island for $53,000. Today, that same tract is worth about $400 million. (Courtesy of Herbert Shapiro)

According to the U.S. Census, the year-round population of Long Beach Island was fewer than seven hundred people in 1920. Half lived in Beach Haven, an established resort near the southern end of the barrier island. It had several large hotels that catered to Philadelphia patricians eager to escape the summer heat and enjoy a few weeks of cool ocean breezes. Another small hotel straddled Tucker’s Island on a wild, migrating spit of sand across from the Beach Haven Inlet, also near the southern tip of the island. It had been developed by Quakers in the 1800s but was now being reclaimed by rising water, and would soon vanish entirely. Most wealthy industrialists of the day headed to Atlantic City, with its notable hotels, glitzy boardwalk, and Jazz Era speakeasies. Or, if they preferred a quieter setting, they might travel to Cape May, with its stately Victorians and deep Quaker influences, or the equally historic Methodist camp of Ocean Grove, in North Jersey. Altogether, the few thousand houses and businesses on Long Beach Island were worth just $3 million when Morris Shapiro arrived, real estate records from the day show. A single city block in Atlantic City was worth more.

And yet, Morris saw a unique opportunity in the pristine but hard-to-get-to island. Sure, most of it was wild now, he told Jennie, but it wouldn’t always be like this. The American economy was strong; people had jobs and money. The beach resorts were growing. Look at Miami and Charleston, South Carolina. Even Galveston, which had been flattened by a hurricane in 1900, was booming. With the resorts close to the big cities already crowded, vacationers would soon begin to look elsewhere to escape. Why not Long Beach Island? It was beautiful and unspoiled.

As it happened, a handful of developers were already advertising the charms of Long Beach Island in the Philadelphia and Camden newspapers. “For sale: 240 splendid seashore lots $40 each,” one advertisement read. “And they say money won’t buy happiness. Well, they’d better guess again,” exclaimed another. The way Morris figured, it was only a matter of time until state officials built a highway from the more populous northern counties to open the island up to development. The smart choice was to get in early. And so, he made his case to Jennie: “I have a good feeling,” he said. “People are going to want to come here. You’ll see.”

Morris Shapiro had a gift when it came to real estate. A few years earlier, he’d begun buying empty lots in Elizabeth for $100, and then quickly turned them around for $200. Morris used the profits to build single-family houses and a commercial office building in downtown Elizabeth with half a dozen tenants. Soon, he had a steady stream of rents and cash. It was a lot easier and far more lucrative than selling rubber boots to dockworkers for 99 cents a pair.

“My father was a smart man. I think he saw right away he was in the wrong business. Real estate was the business to be in,” recalled Morris’s son Herb, now ninety-six but still possessing a subtle memory. “I remember the first time I came here to the island. I was probably four years old. There was nothing here. It was desolate, with wild blackberries growing in the streets. But my father had a vision. He could see opportunities no one else saw.”

Eventually, Jennie saw it, too. The more she listened to her husband, the more she warmed to the idea. Morris had brought along a check for $53,000 made out to the Highland Beach Corporation, Kenyon’s company. It was an interesting name, given that the island was only seven feet above sea level at its highest point. Not that Morris was worried about elevation or storms at that moment. That was a concern for the distant future, for his children and their sons and daughters.

Today, the fifty-three acres that Morris Shapiro purchased in 1926 would be worth around $400 million, according to my analysis of property records. That’s an appreciation of over 7,500 percent in ninety years—or a 530-fold increase, after adjusting for inflation.

Still, even as inspired an investor as Morris Shapiro couldn’t possibly have imagined the extraordinary land rush that would one day transform Long Beach Island from a humble fishing village and blue-collar resort into an increasingly lavish confection for the rich. Today, nineteen thousand houses and businesses crowd the low, slender barrier island. Vacation houses sell for an average of $1 million, with oceanfront houses topping $10 million. There are traffic jams, floods from overwhelmed sewer and stormwater systems, and barely a whisper of air between the ever-larger beach houses stacked side by side in many neighborhoods.

The story of Long Beach Island mirrors the larger narrative of America’s coasts, now congested with trillions of dollars of lavish yet astoundingly vulnerable property. The slim barrier island has been wrecked twice by storms, bookended almost fifty years apart, with about a billion in damages in Sandy alone. Yet officials and developers ignored the palpable risks and built back after each storm, aided by government disaster dollars and federal flood payments. That, too, mirrors the larger, often contradictory narrative of America’s coasts, conceived in modesty by men such as Morris Shapiro, but now gilded with entitlement.

* * *

Even as Morris Shapiro was discovering Long Beach Island in 1926, America was already experiencing a real estate bubble at the coast. But instead of New Jersey, it was in swampy Florida, 1,200 miles to the south, where a mix of entrepreneurs, real estate wildcatters, hucksters, and con men were hawking owning beachfront property as the next American dream. Most of the action was in the fledgling developments of Miami Beach, Fort Lauderdale, and West Palm Beach. But the land fever extended as far west as Sarasota and Tampa, and as far south as Key West, thanks to an overseas railroad built by the industrialist Henry Morrison Flagler, John D. Rockefeller’s longtime business partner in Standard Oil.

Flagler was already a successful entrepreneur and investor when he met Rockefeller in the mid-1800s. In 1863, he helped secure a $100,000 loan so the then cash-strapped Rockefeller could fund his fledgling oil business. Flagler received 25 percent of the new company, which quickly became the leading oil refinery business in America. But in time, Flagler grew bored with the oil business, and in the 1880s shifted his attention to Florida, which he believed would one day attract large numbers of tourists seeking to flee the harsh northern winters. Flagler built hotels in Daytona, Palm Beach, St. Augustine, and Miami, and purchased a railroad that eventually traversed the state’s eastern coast. But Flagler wasn’t done. He was intent on linking Key West to Miami, and eventually with the Panama Canal, establishing trade routes with Cuba and other Caribbean outposts. His extended railroad ran from the small city of Homestead, about forty miles southeast of Miami, through the Everglades and across twenty-five miles of open water at Big Pine Key, down to the Lower Keys. Built at an astonishing cost of $50 million (nearly $800 million in today’s dollars), it was sometimes referred to as the Eighth Wonder of the World.

The speculative frenzy reached such heights that The New York Times saw fit to start a stand-alone real estate section chronicling the Florida land rush. But land rushes come and land rushes go. This one had already begun to wane when a devastating hurricane slammed into Miami in 1926, the same year Morris Shapiro arrived on Long Beach Island. The storm caused over $100 million in damage, an extraordinary sum for the time, marking it as one of the most catastrophic hurricanes in history. Only a few years later, two more hurricanes killed thousands of Floridians and swamped Flagler’s railroad, by then in bankruptcy, effectively popping the nation’s first coastal real estate bubble. Both the speculative land rush and the hurricanes foreshadowed what would become a familiar script at the coast—a loop of intense development followed by ruinous storms, followed by costly rebuilding, followed by yet more storms and then even more building.

Florida is perhaps the best example of unchecked development at the coast. In 1920, fewer than one million people lived along the state’s fifty barrier islands and scores of canals, swamps, and bays. Only three decades later, the population had swelled threefold. Not content to build solely along the shoreline, developers began to fill thousands of acres of wetlands, mangrove swamps, and tidal creeks for thousands of houses for retirees fleeing cold-weather states in the North. By 1980, the population had soared to nearly ten million. Today, it is over twenty million, with six million alone in the congested Miami-Dade metropolitan area. Most live atop porous limestone outcrops or canals that are ready-made conduits for floods and storm surge. Especially during king tides, full moons, and heavy downpours, residents are sometimes trapped in their low-lying bungalows by rising water, with nowhere to go. The city of Miami itself hasn’t been hit directly by a major hurricane in decades. But it is only a matter of time. Researchers estimate that a storm as powerful as the Great Miami Hurricane of 1926 would cause $250 billion in damage today—more than Hurricanes Katrina and Sandy combined.

Copyright © 2019 by Gilbert M. Gaul

Map copyright © 2019 by Jeffrey L. Ward